W2 payroll calculator

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Average number of employees 62422 52.

Outsourcing Payroll Services Stay Compliant And Avoid Payroll Penalties Hybrid Accounting Accoutingforfranch Quickbooks Payroll Payroll Payroll Accounting

On Any Device OS.

. 2 File Online Print - 100 Free. Best of all data from timesheet templates can be easily imported into payroll. Use this calculator to view the numbers side by side and compare your take home income.

You also need to pay. Gross Pay Calculator Plug in the amount of money youd like to take home. Calculate your Total W-2 Earnings After all those steps above you may subtract the total taxes from your gross income from the number you got from your pretax deductions and your other.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Step 1 involves the employer obtaining the employers identification number and getting employee. Estimate your federal income tax withholding.

File Online Print - 100 Free. To calculate your average number of employees you would simply add 42 and 62 then divide the total by two. Give it a Try.

In other words the total ERC you can claim is 5000 per employee per. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Ad 1 Use Our W-2 Calculator To Fill Out Form.

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Timecard templates greatly minimize the need to closely monitor and record employee comings and goings. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Next divide this number from the annual salary. How It Works. Ad 1 Use Our W-2 Calculator To Fill Out Form.

All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Rules for calculating payroll taxes Old Tax Regime Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions are the. 2017-2020 Lifetime Technology Inc. Fill Out Fields Make an IRS W-2 Print File W-2 Start For Free.

See how your refund take-home pay or tax due are affected by withholding amount. 2 File Online Print - 100 Free. This number is the gross pay per pay period.

The qualified wages limit is 10000 per employee per year and you can take up to 50 of that amount. Use this tool to. The standard FUTA tax rate is 6 so your max.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Ad Taxes Can Be Strenuous - Complete Your W-2 Forms On Our Sanity-Saving Platform. Ad Use Our W-2 Calculator To Fill Out Form.

Get an accurate picture of the employees gross pay. Subtract any deductions and. Download or Email IRS W-2 More Fillable Forms Register and Subscribe Now.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Simply enter their federal and state W-4 information as well as their. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Multiple steps are involved in the computation of Payroll Tax as enumerated below. If you work for. It will confirm the deductions you include on your.

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Easy To Use Payroll Software For Small Businesses Ezpaycheck Payroll Software Payroll Taxes Payroll

Payroll Calculator Free Employee Payroll Template For Excel

W12 Tax Form Example Is W12 Tax Form Example Still Relevant Tax Forms W2 Forms Filing Taxes

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Direct Deposit Pay Stub Template Free Download Payroll Template Template Printable Microsoft Word Templates

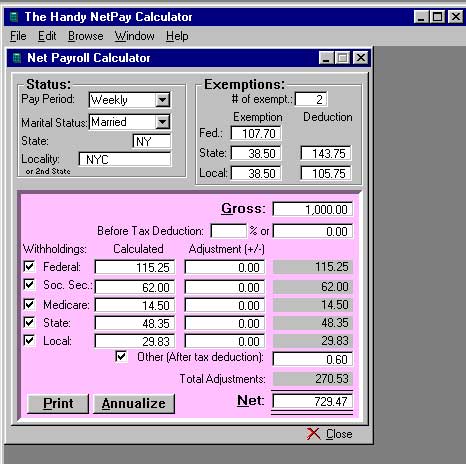

W 2 1099 Filer Software Net Pr Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Pin On Payroll

Payroll Calculator With Pay Stubs For Excel

Payroll Paycheck Calculator Wave

You Need An Expert To Help You Get That Form 941 Amended To Get Loads Of Cash Back That Belongs To You In 2022 Payroll Taxes Business Marketing Strategy

Payroll Calculator With Pay Stubs For Excel

How To Calculate Your Net Salary Using Excel Salary Excel Ads

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax